A Disciplined Methodology Underlies

Everything We Do

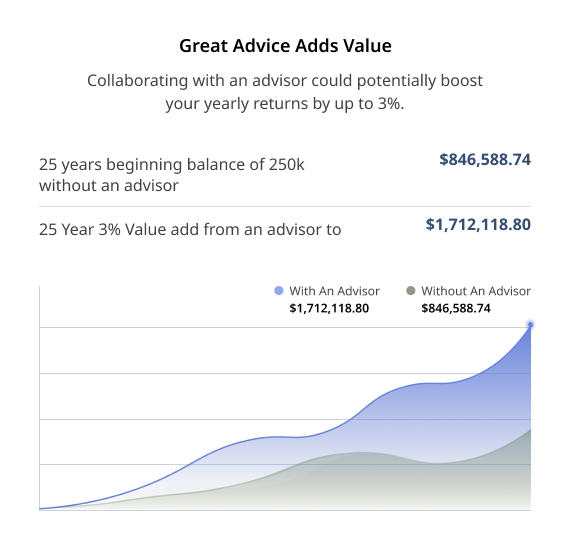

| Studies show Integrated Planning can add up to 3% annually. |

|

| Additional Return Source: | Value-add: |

|---|---|

| Financial Planning | 0.5% |

| Asset Class Selection and Allocation | 0.28% |

| Investment Selection: | |

| Active Management or | .85% |

| Passive Management | .82% |

| Systematic Rebalancing | .44% |

| Tax Management | 1% |

| TOTAL Value Added 3% | |

Source: Envestnet Research; Morningstar Research; Vanguard Research

Our Process

Discover What To Expect

Implementation

A plan for what's next

JAN - FEB

Winter clients; Annual review with your dedicated wealth management advisor

planning consultations

Estate planning consultations

Prior-income year tax preparation

with CPA partner

Quarterly guidance newsletter

MAR - APR

MAY - JUN

Spring & Summer clients Annual review with your dedicated wealth management advisor

Insurance planning consultations

Tax planning consultations

Investment planning consultations

Cash-flow planning consultations

Estate planning consultations

JUL - AUG

SEP - OCT

Fall clients; Annual review with your dedicated wealth management advisor

Quarterly guidance newsletter

Insurance planning and open enrollment consultations

Year-end tax planning and projections

Charitable giving consultations

NOV - DEC

JAN - FEB

Winter clients; Annual review with your dedicated wealth management advisor

planning consultations

Estate planning consultations

MAR - APR

Prior-income year tax preparation

with CPA partner

Quarterly guidance newsletter

MAY - JUN

Spring & Summer clients Annual review with your dedicated wealth management advisor

Insurance planning consultations

Tax planning consultations

JUL - AUG

Investment planning consultations

Cash-flow planning consultations

Estate planning consultations

SEP - OCT

Fall clients; Annual review with your dedicated wealth management advisor

Quarterly guidance newsletter

NOV - DEC

Insurance planning and open enrollment consultations

Year-end tax planning and projections

Charitable giving consultations